Best Small Business Lender

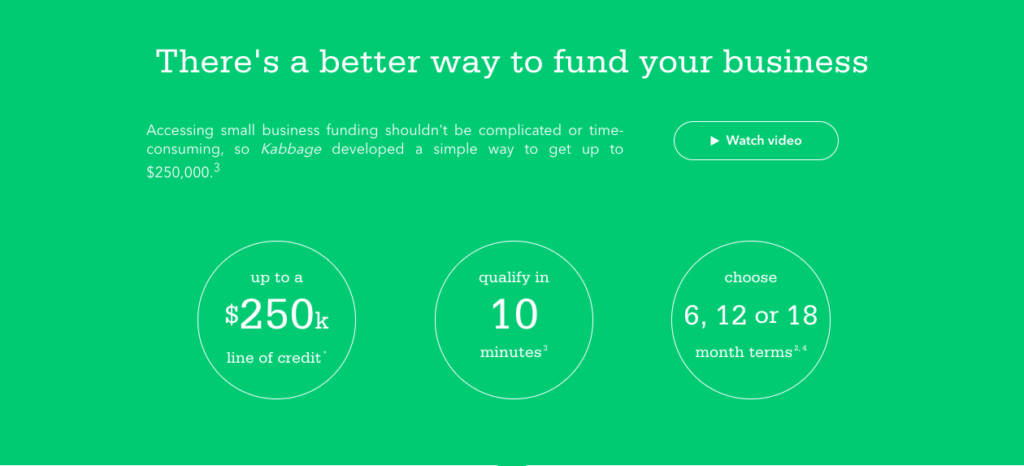

Kabbage is a technology company that quickly connects small businesses with capital. Their technology platform reviews data generated by dozens of business operations to automatically understand business performance and deliver fast, flexible funding entirely online.

Spend time on your business — not paperwork

Kabbage looks at your business performance — not just a credit score — to let you know right away how much funding you can access.

Apply in minutes. Qualify in no time.

Their Competitors

Kabbage is a financial technology and data company pioneering a new, automated way for small businesses to access working capital. The company simplifies the manual application process to one that is 100% online and automated. Businesses can use their business data to submit an application online and receive an answer in minutes instead of waiting weeks and filling out numerous forms like traditional lending methods. Businesses can access ongoing lines of credit up to $250,000.

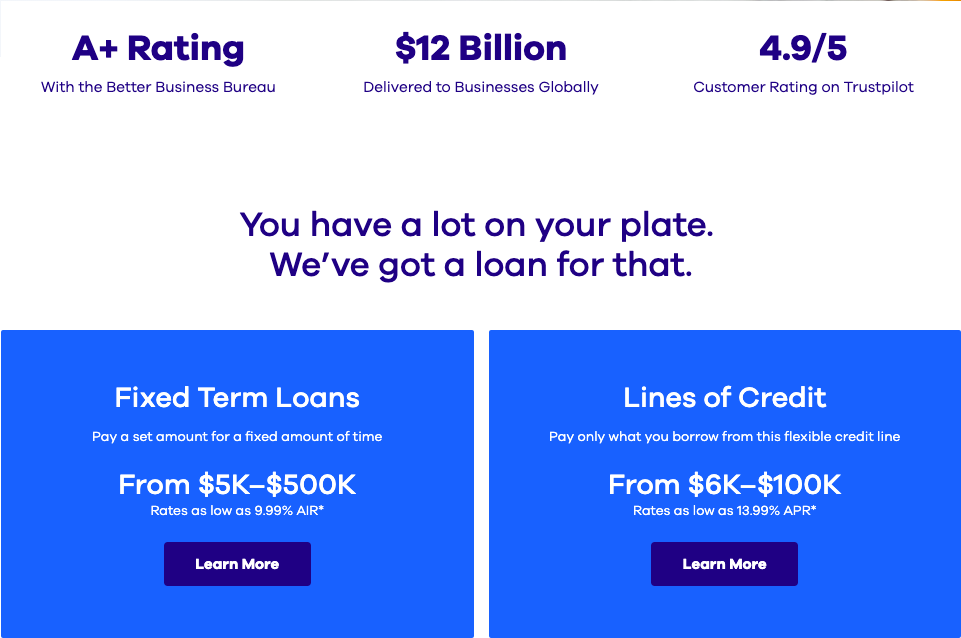

OnDeck is the largest online small business lender in the U.S. Since 2007, they’ve issued over $12 billion in loans for many business needs including inventory purchase, equipment acquisition, hiring, and general corporate purposes. Serving more than 700 industries throughout the country, OnDeck has been trusted by over 100,000 small businesses by providing them with a term loan or line of credit to help them build a growing and thriving enterprise.

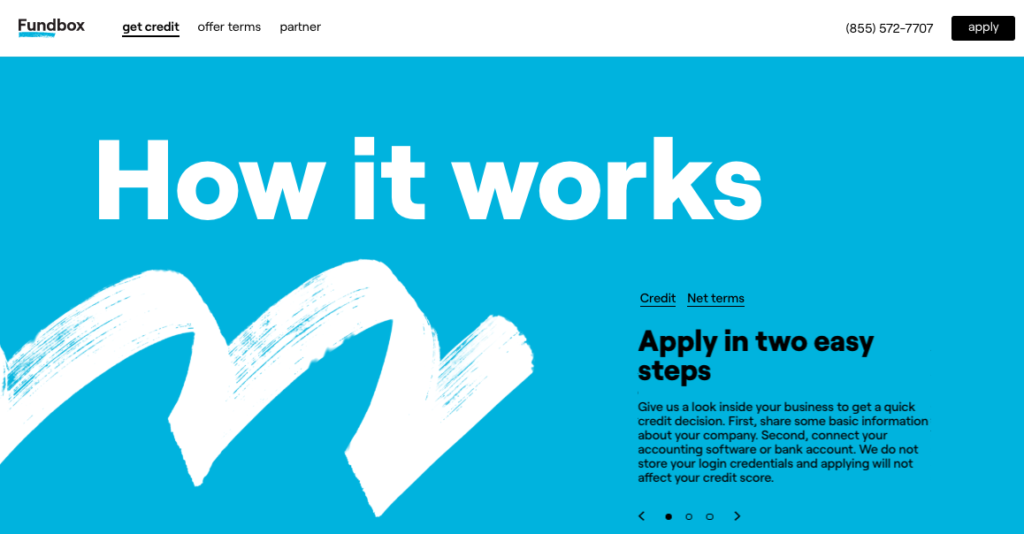

Fundbox is a fintech company based in San Francisco. Founded in 2013, the service uses big data analytics, engineering, and predictive modeling to help optimize cash flow for small businesses and freelancers with outstanding invoices. The organization has received funding from venture capital firms such as General Catalyst Partners, Khosla Ventures, Blumberg Capital, and NyCa Investment Partners. As of 2015, the company had raised a total of $107.5 million in funding from 11 investors.

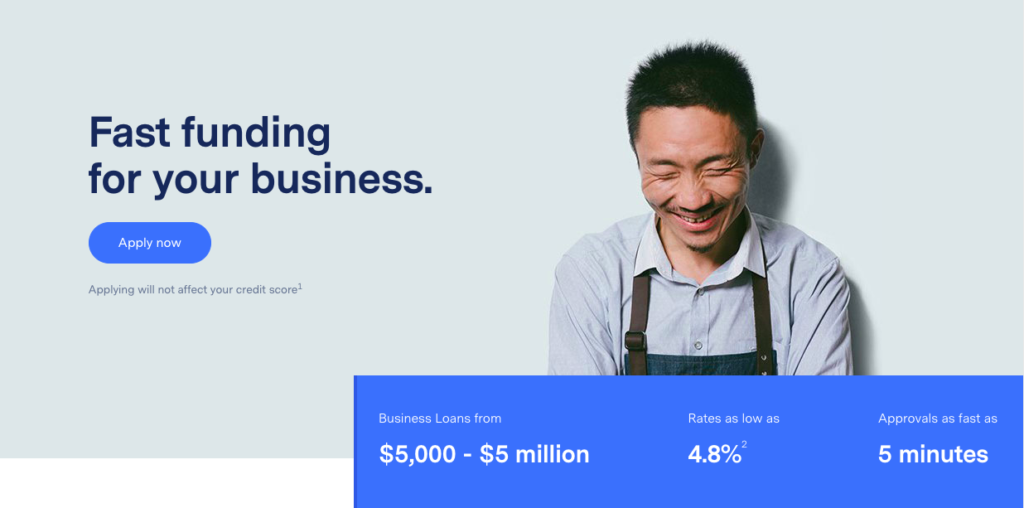

They work hard every day to provide small businesses like yours access to capital when you need it. By combining the latest advancements in technology and security with the expertise and care of their team, they were able to serve business owners nation-wide with efficiency, simplicity, and honesty.

At BlueVine, they are proud to be the answer for thousands of small business owners who rely on us every day to equip them with the funds they need to achieve their business goals.

LendingClub is a US peer-to-peer lending company, headquartered in San Francisco, California. It was the first peer-to-peer lender to register its offerings as securities with the Securities and Exchange Commission (SEC), and to offer loan trading on a secondary market. LendingClub is the world’s largest peer-to-peer lending platform. The company claims that $15.98 billion in loans had been originated through its platform up to December 31, 2015.

LendingClub enables borrowers to create unsecured personal loans between $1,000 and $40,000. The standard loan period is three years. Investors can search and browse the loan listings on LendingClub website and select loans that they want to invest in based on the information supplied about the borrower, amount of loan, loan grade, and loan purpose. Investors make money from interest. LendingClub makes money by charging borrowers an origination fee and investors a service fee.

At Headway Capital, they appreciate the effort it takes for small businesses to reach their goals, and they understand that banks aren’t always a viable option for credit. Accessing capital should be easy and clear. They believe you can accomplish great things with the right support, and they are proud to help hardworking business owners like yourself find continued success. That’s why they strive to be a partner you can trust.

Customer Reviews

How to apply?

Enter your email address and password so you can return to Kabbage anytime. Then enter your business name, type and industry to help us understand your business.

With secure, ongoing access to your accounts, we can review your revenue in a fraction of the time it takes traditional lenders and can provide the right amount of funding at the right time based on your latest business performance.

Security is their first priority. They use the highest encryption standards to protect your accounts. They can never see or store your personal information.

They will assess your business performance to let you know how much funding you can access.

They analyze a variety of financial performance indicators like revenue consistency, cash flow and the business owner’s consumer credit, so one factor won’t necessarily keep you from qualifying.

Rates & Terms

Instead of one-time loans, Kabbage offers ongoing lines of credit1 up to $250,000. You can use any increment.

Applying with Kabbage is simple, and there’s no obligation to use funds if you’re qualified. Your line of credit will be there when you need it, and you won’t pay anything until you actually withdraw funds.

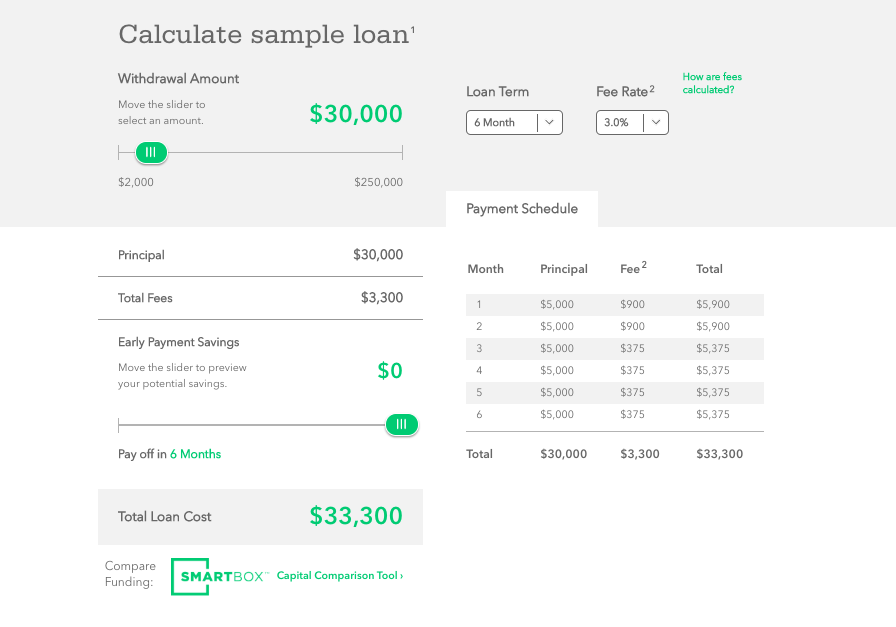

Kabbage loans have simple, monthly fees. You’ll only pay for what you use.

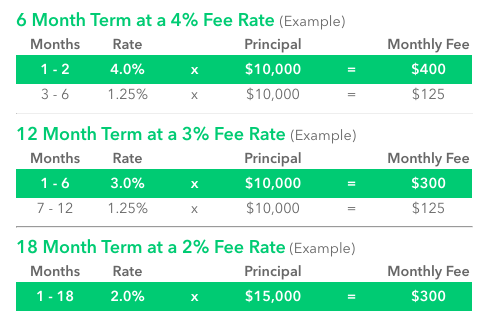

How are fees calculated?

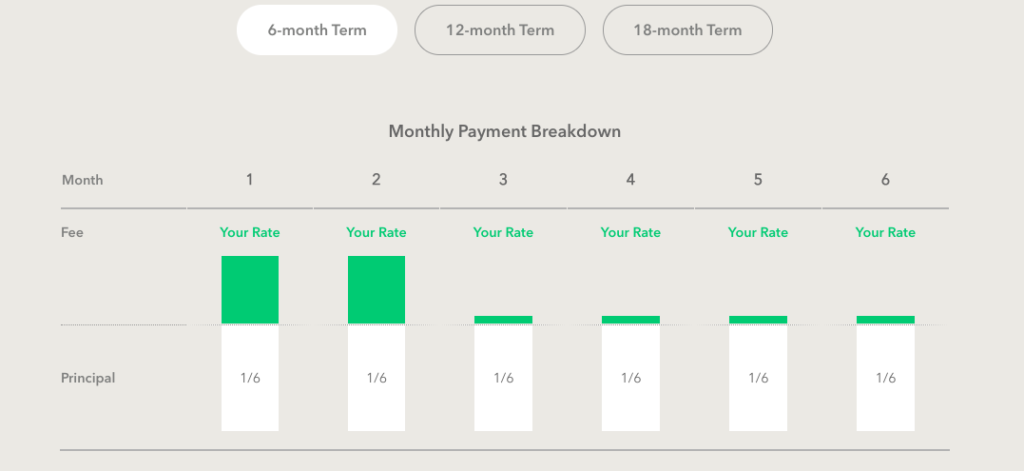

Every month, you’ll pay back an equal portion of the loan principal plus the monthly fee. Kabbage® 6- or 12-month loans have a fee every month you have a balance, while 18-month loans have the loan fees accrued in full at the time the loan is funded and an equal portion of the fee is paid each month for 18 months, regardless of reduction of your balance.

What Fee Rate should I expect?

Fee Rates range from 1.5% to 10% based on a number of business performance factors. Apply to find out what your Fee Rate could be.

Kabbage offers the flexibility of 6-, 12- or 18-month loan terms so you can choose what’s best for your business.2

- Every month, you pay back an equal portion of the loan principal plus the monthly fee.

- 6-month terms require a $500 minimum loan.

- Your Fee Rate will be between 1.5% and 10% of the principal loan amount.

There are no prepayment penalties, so you can pay your loan off early and save on monthly fees.

Sample loan calculation. Check it here.

Common Questions

When polled, most business owners shared that access to capital is the single biggest roadblock to growing their businesses. With more cash flow, these businesses can hire new employees, purchase more inventory, upgrade equipment and boost their marketing efforts.

Kabbage has a very nice loan calculator on its website, which may be helpful for understanding how the fees work. Be aware that, due to the way the fees are issued, Kabbage loans do not technically carry an APR. However, the estimated APRs range from about 24% to 99%.

And in general, the more accounts you can link to your Kabbage application, the more business data and information Kabbage can use to underwrite your line of credit. After Kabbage reviews a full application, it can take anywhere from minutes to three to five business days to approve an offer.

| Type of site | Financial Services |

|---|---|

| Owner | Privately Held |

| Created by | Rob Frohwein Kathryn Petralia Marc Gorlin |

| Revenue | $200 million(2017) |

| Website | www.kabbage.com |

Kabbage does not report to the major credit bureaus (Experian, Equifax, and TransUnion), so your timeliness in paying back your loan does not affect your credit in any way. However, if you are delinquent in paying back your loan, they may report to one of the credit bureaus.

Kabbage generates revenue from fees on its loans. … The company claims to have a loss rate lower than the rest of the industry, and that its direct lending business had turned profitable in the fourth quarter of 2016.

Our Conclusion

Kabbage is a good option for business owners who don’t have perfect personal credit and need cash immediately and don’t mind paying higher rates for the speed. Kabbage focuses on less traditional information like banking, accounting and e-commerce data. With their easy online application that can be completed in minutes, you can be approved for a line of credit and funded within a few days, at most. They offer offers loans of up to $250,000 with repayment terms of six, 12 or 18 months.

Fernando Camacho

Categories

- Accounting Software

- AirBnB Property Management

- Alimento Mascotas

- Art

- Awards

- BadenBower

- Beauty

- Blog

- Business Banking

- Business Coaching

- Business Services

- Car Tyre

- CEO Training & Education

- Community Services

- Courier Services

- Credit

- Credit Cards

- Cryptocurrency

- Cybersecurity

- Data Heatmap

- Data Privacy Management Software

- Dating

- Destacados

- Digital Marketing

- E-commerce Platform

- e-Signature

- Ecommerce

- eCommerce Analytics

- Education & Training

- Electrical Services

- Email Signature Software

- Energy

- Enterprise

- Entertainment

- Events Management

- Fashion

- Featured

- Finance

- Find a Tradie Websites

- Fintech

- Fitness

- Food

- Food & Restaurants

- Fragrance

- Furniture

- Gaming

- Graphic Design Software

- Groceries

- Hair Care

- Health

- Help Desk Software

- Hotels

- Insurance

- Interiors

- Inventory Management Software

- Inventory Management Systems

- Investment

- kids

- Landing Page Builder

- Legal

- Legaltech

- Logistics

- Logo Maker Software

- Marketing

- Marketing Automation Software

- Marketplace

- Mattresses

- Medical

- Money

- Motorsport

- Music

- Music Streaming

- Online Backup Software

- Online Business

- Online Literature

- Online Marketplaces

- Online Security

- Outsourcing

- Outsourcing Companies

- Payment Processing

- Payment Services

- Pest Control

- Pet Food

- Plumbing

- PR Agency

- Prescription Glasses

- Project Management Software

- Property Management

- Publicity

- Real Estate

- Real Estate Agent Comparison

- Recruitment Automation

- Rental

- SaaS

- Sales Analytics Software

- Service Industry

- Shipping Software

- Shopping

- Shopping Deals

- Software Translation Services

- Super Funds

- Survey Software

- Tech

- Time Sheeting Software

- Travel

- UX Design

- Watches

- Web Scraping

- Web Scraping Services

- Website Builder

- Wedding & Engagement

- Writing & Author