5 Best Business Loans in Australia

May 2021 Review: Who Do We Recommend?

Prospa won our comparison based on number of reviews (6,195 & 4.9 stars), highest levels of transparency, customer service and great marks for their application process and timeline.

February 2021 Review:

Best Small Business Loan Provider in NZ

For sole traders and business owners seeking help to grow their business (or keep the lights on in times of trouble), there are many companies to choose from. We’ve researched the business loan industry to recommend the best option based on customer reviews, services offered and established track record.

Criteria For Selecting Our Top Small Business Loan Provider: We looked online for the number of customer reviews left from real genuine customers, the aggregate score of the particular lender and looked at factors like transparency, customer service, application process and timeliness. We also checked out their best deals.

Why we love Prospa: They are the #1 online lender to small businesses, having the most number of reviews, highest levels of transparency, customer service with great marks for their application process and timeliness. They are assisting SMEs with fast funding to protect against decreasing revenues, cash flow issues, supplier payments and more.

Top 5 Business Loan Providers

A Prospa Small Business Loan is a lump sum of between $5,000 and $300,000 with fixed repayments that work with business cash flow. The application process is easy and funding is possible in 24 hours.

- Need to be in business for at least 6 months prior to applying

- A lump sum between $5,000 and $300,000 over a term of 3 to 36 months

- Origination fee is 3%

- Apply in 10 minutes with minimal paperwork required (business financials required for over $150,000)

- Fast decision with funding possible in 24 hours

- No asset security required upfront to access up to $100,000

$5000 – $300,000 within 24 hours

- A lump sum between $5,000 and $300,000 over a term of 3 to 36 months

- Apply in 10 minutes with minimal paperwork required (business financials required for over $150,000)

- Fast decision with funding possible in 24 hours

- No asset security required upfront to access up to $100,000

Early repayment discounts available

- Set repayments (daily or weekly) to work with your business cash flow

- Early repayment discounts available

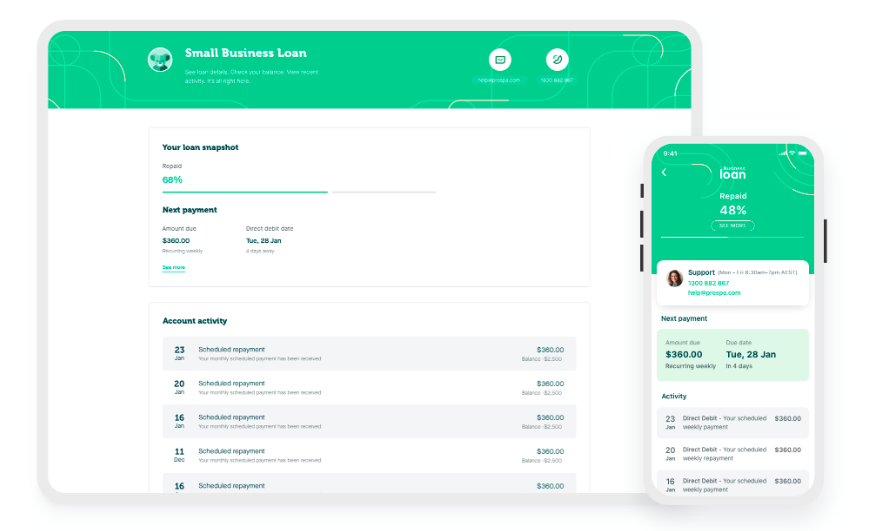

- Check balance wherever and whenever on the Prospa Mobile App and Customer Portal

Great customer support

- A team of Business Lending Specialists available however suits you – phone, email, chat

- Business resource hub to help you stay informed

- Competitive rates tailored to the health of your business

- Transparent fees: 3% origination fee

Other small business loan providers include Moula, Get Capital, On Deck.

Cumulatively, they have fewer positive reviews than Prospa.

How It Works

You could qualify for a Prospa loan if you have been trading for at least 6 months, and have an average turnover of $6k per month

You need to be an Australian citizen, have an ABN and be a business owner in Australia.

With funding possible in 24 hours and 24/7 access via the Prospa Mobile App and Customer Portal.

What could your business do with a cash lump sum?

- Purchase equipment or tools

- A renovation or fit out

- Upgrade equipment or machinery

- Marketing campaigns or promotions

- Build a website

- Buy office or café furniture

- Pay tax or BAS lump sums

Our Conclusion

Prospa tops the list of small business loans providers. Unlike traditional lenders, Prospa understands small business owners need faster finance solutions – so you can make decisions quickly and seize opportunities with total confidence.